Goldman Sachs acquired SVB’s bonds pre-termination

JAKARTA – Goldman Sachs Group is revealed to be the buyer of the Bonds of Silicon Valley Bank (SVB), recording a total loss of USD 1.8 billion.

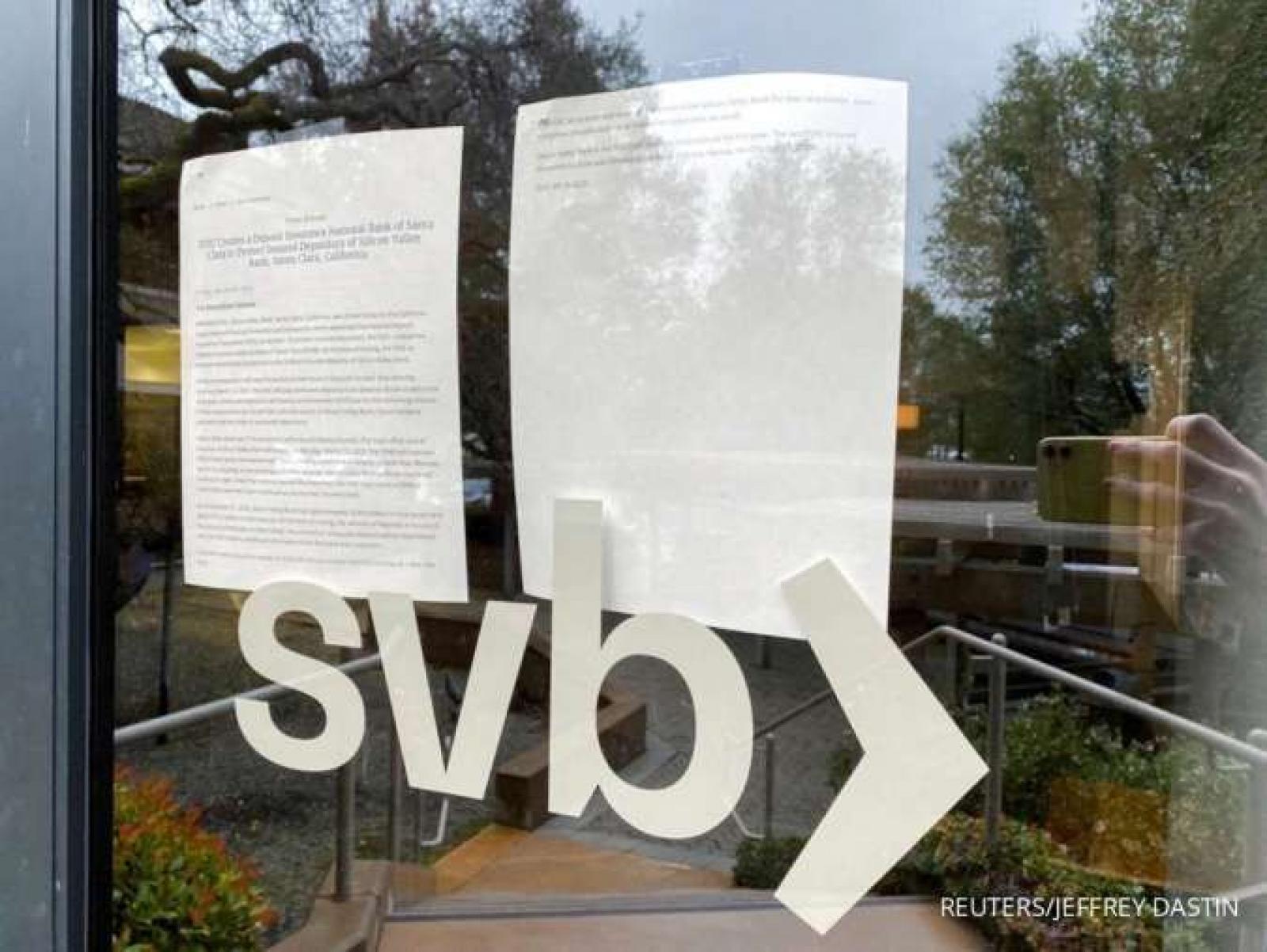

Quoted from Reuters today (14/3), the management of SVB Financial Group confirmed that the loss from said bonds’ sales had forced SVB to sell off its shares for USD 2.25 billion last week (8/3), two days before being officially dissolved on March 10.

The portfolio of SVB’s bonds that was sold to Goldman Sachs mostly consists of treasury notes from the United States Financial Department with a total book value of USD 23.97 billion. The transaction was conducted using negotiated price, thus only returning USD 21.45 billion, way below the actual book value.

The bonds purchase was handled by a different division from another that managed SVB’s stock sales.

According to Jacob Frenkel, Chief of Government Investigation and Security Enforcement Practice of Dickinson Wright, claimed that the separation of divisions was commonly practiced by major banks in order to avoid conflicts of interests. (LK/ZH)