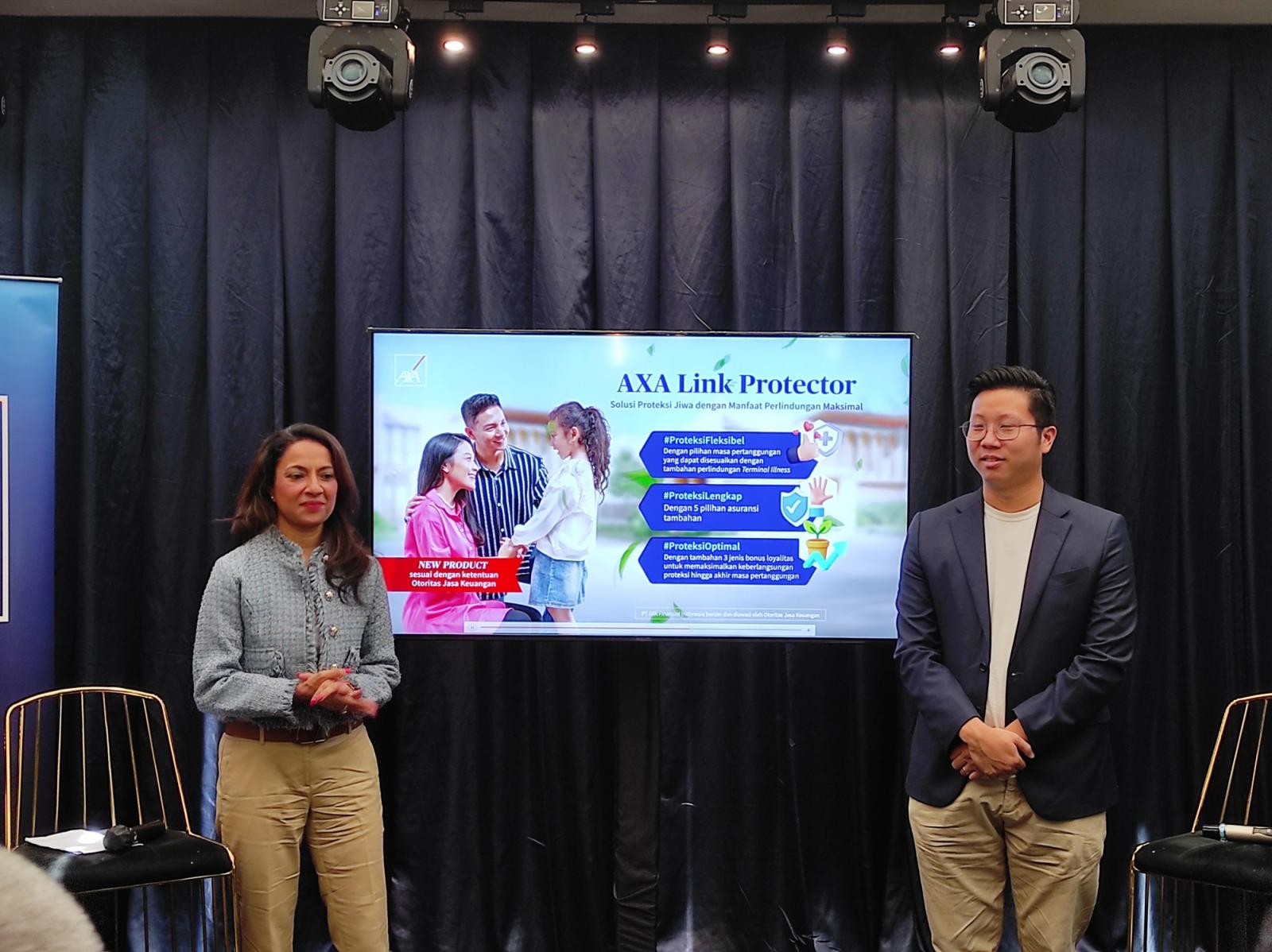

AXA Financial Indonesia introduces its unit link product, AXA Link Protector

JAKARTA – Amidst the recent talk regarding investment-linked insurance plan (unit link) and the implementation of SEOJK No.5/2022, AXA Financial Indonesia launches AXA Link Protector, its investment-linked insurance product that offers protection as well as investment value.

Niharika Yadav, President Director of AXA Financial Indonesia, claimed that AXA Link Protector has fully complied with Circular Letter of Financial Services Authority (lit. Surat Edaran Otoritas Jasa Keuangan/SEOJK) No.5/2022. This product offers life insurance while allocating up to 60% of the premium for the first year of investment, even 100% on its second year.

AXA Link Protector provides two alternatives for its users, AXA Link Protector Premier and AXA Link Protector Executive, with monthly base premium starting from IDR 500 thousand or USD 50. “We are targeting mid-class, affluent, and high-network user segments. The option for premium in USD is highly sought by our high-network users, which provides healthcare insurance applicable in cross-border healthcare facilities, including in the US,” Yudhistira Dharmawata, Chief of Proposition and Alternate Distribution of AXA Financial Indonesia, explained during the Press Conference of AXA Link Protector in Jakarta today (5/4).

The unique value in this product is the option of five health-related riders that could be coupled with the primary insurance benefits. "It allows users to have a life insurance, as well as health insurance, to optimise their protection," Dharmawata added further.

AXA Financial Indonesia is listed under AXA Group, a Paris-based insurance and asset management company. It is headquartered in Jakarta, owning 55 marketing offices and managing 5,000 certified salespeople. (ZH)