Asian capital market threatened by US banking crisis

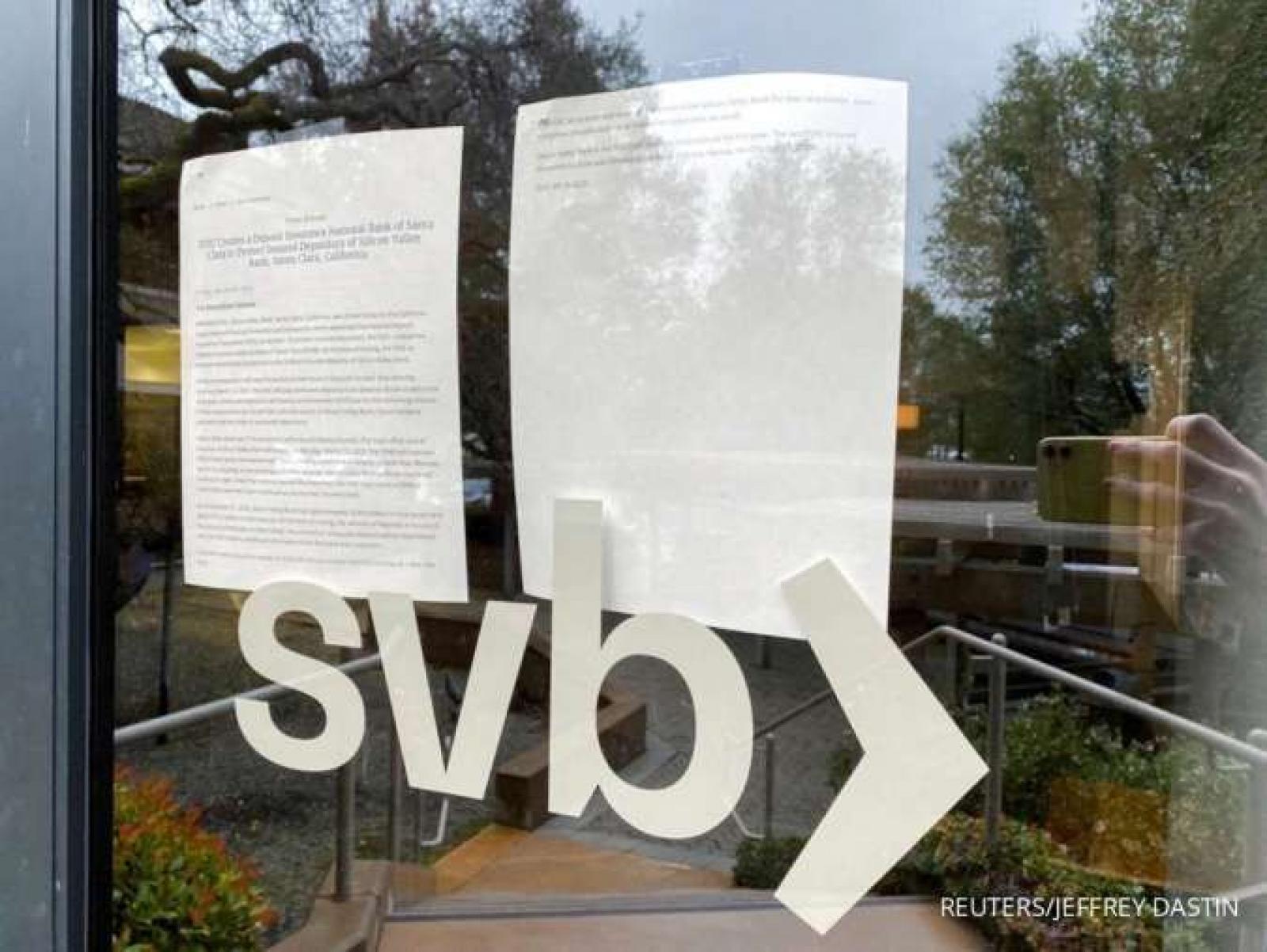

JAKARTA – The capital market in Asia was reported declining on March 14, 2023, following the emerging banking crisis in the United States after Silicon Valley Bank and Signature Bank were dissolved. Japanese capital market is reportedly the most affected one among many in Asia.

Quoted from Reuters, the downfall of both banks in the US within the past week had induced mass shares sales, which, consequently, dragged down banking stocks in the US. It was initially triggered by the Fed’s, US central bank, decision to raise interest rate.

Today (14/3), the MSCI for Asia-Pacific market outside Japan reportedly decreased 0.5% in the first trading session. Furthermore, the domino effect also fell upon the Australian capital market (AXFJ).

The Nikkei (N225) was recorded declining 2%, while the Tokyo Stock Exchange's Banks Index (IBNKS.T) followed with 7.4% decrease during the opening of today’s trading session. These are said to be the most prominent decline within the past three years.

Darmien Boey, Chief of Equity Strategist in Bank Barrenjoey, Sydney, claimed that bank run has started to take place in the interbank market. According to Boey, the liquidity measures should be able to put the current dynamics on halt. However, Main Street has been watching the news, not financial plumbing measures, thus allowing current anxiety to grow within the market. (LK/ZH)