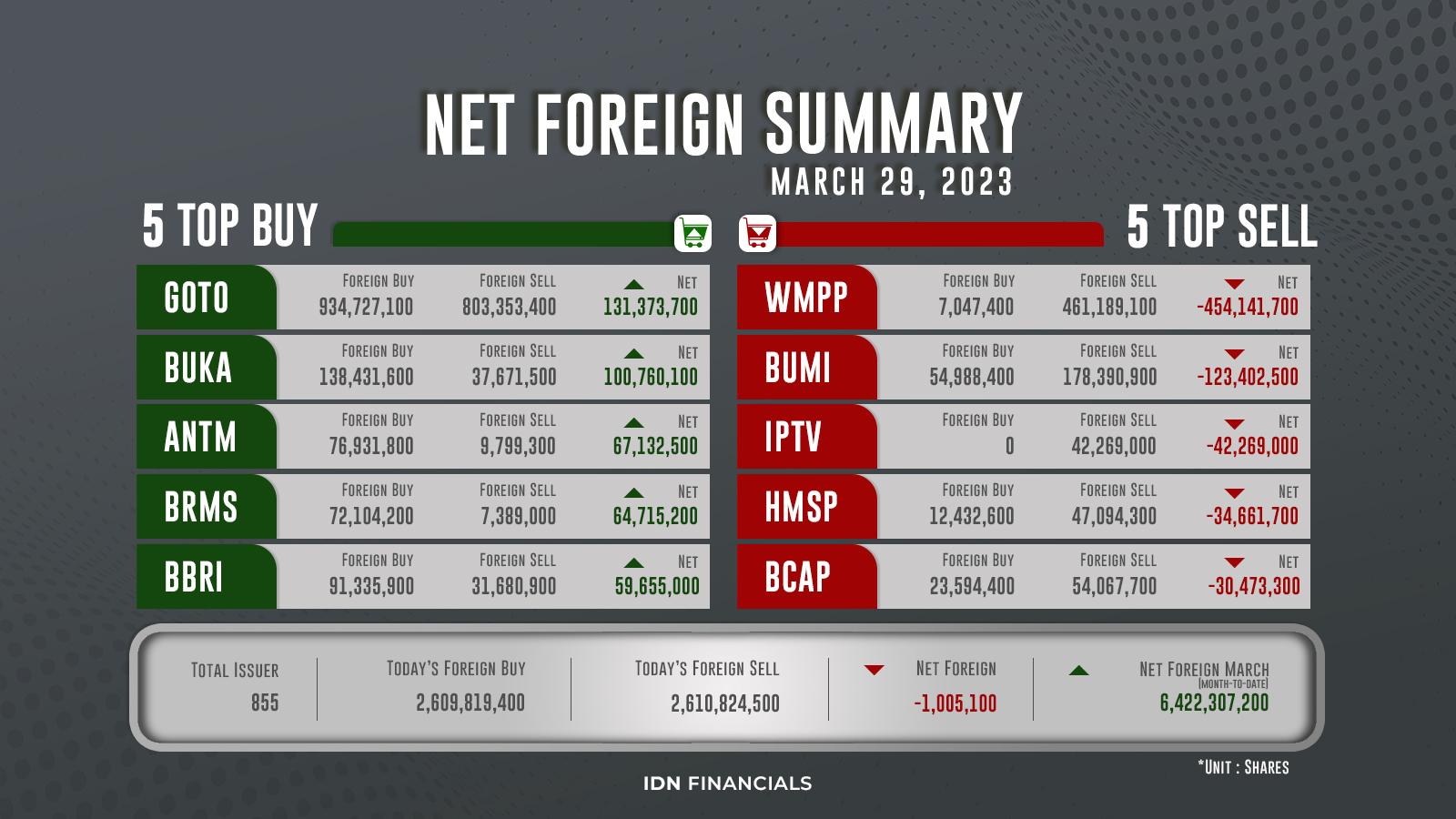

Foreign investors sold many WMPP shares; its net volume dropped to -454 million shares

JAKARTA - On Wednesday, March 29, foreign investors' trade ended with a tiny margin. Foreigners purchased a total of 2.60 billion shares, while they sold 2.61 billion. Even though it was a net foreign minus, the quantity was quite tiny, at -1,005,100 shares only. Unfortunately, the net volume of PT Widodo Makmur Perkasa Tbk (WMPP) shares dropped to negative 454.14 million. Foreign investors sold 461.18 million shares of WMPP, whereas the buying volume was just around 7 million shares. PT GoTo Gojek Tokopedia Tbk (GOTO) shares, on the other hand, had a net volume surplus of 131.37 million shares with a purchase volume of 934.72 million.

Besides that, other overseas investors sold PT Bumi Resources Tbk (BUMI) shares in as high a quantity as 178.39 million, with a net volume of -123.40 million shares. Furthermore, 42.26 million shares of PT MNC Vision Networks Tbk (IPTV) were sold, resulting in a negative net volume of the same amount because no IPTV shares were purchased by foreigners. PT MNC Kapital Indonesia Tbk (BCAP), another member of the MNC Group, reported a net volume of -30.47 million shares after foreigners sold 54.06 million of its shares. PT Hanjaya Mandala Sampoerna Tbk (HMSP) shares have also been dispersed in large quantities this time. Over 47 million HMSP shares were sold, for a net volume of approximately -34.66 million shares.

Meanwhile, PT Bukalapak.com Tbk (BUKA) had the second-highest foreign buying, with 138.43 million shares. BUKA's net volume itself was relatively high, at over 100 million shares. PT Aneka Tambang Tbk (ANTM) and PT Bumi Resources Minerals Tbk (BRMS) likewise reported net volumes in the 64–67 million share range. Foreign investors purchased around 76.93 million ANTM shares and 72.01 million BRMS shares. Finally, the shares of PT Bank Rakyat Indonesia (Persero) Tbk (BBRI) are in the last top-buy position, with a net volume of almost 60 million shares, despite the fact that 91.33 million BBRI shares were bought. (KD)

IDN Financials has the most recent foreign investment news!